Navigating Point of Consumption Tax (POCT) Grouping Provisions: What Wagering Service Providers need to know

Each Australian state and the Australian Capital Territory has, over the last seven years, introduced tax regimes, which apply to licensed wagering service providers (WSP) including bookmakers, betting exchange operators and corporate bookmakers, known as point of consumption tax (POCT).

The POCT regime enables each relevant government to collect tax revenue from licensed WSP based on the location of their customer at the time of placing the wager. For example, in New South Wales, RevenueNSW is responsible for administering the POCT, including collecting and managing compliance for all wagers placed by customers located in New South Wales at the time of placing the bet with any WSP licensed in Australia.

While this is not new, WSP offering wagers to customers based in Victoria need to be aware of the grouping provisions which could mean the WSP is considered part of a large group of WSP meaning the obligation to pay POCT could be impacted.

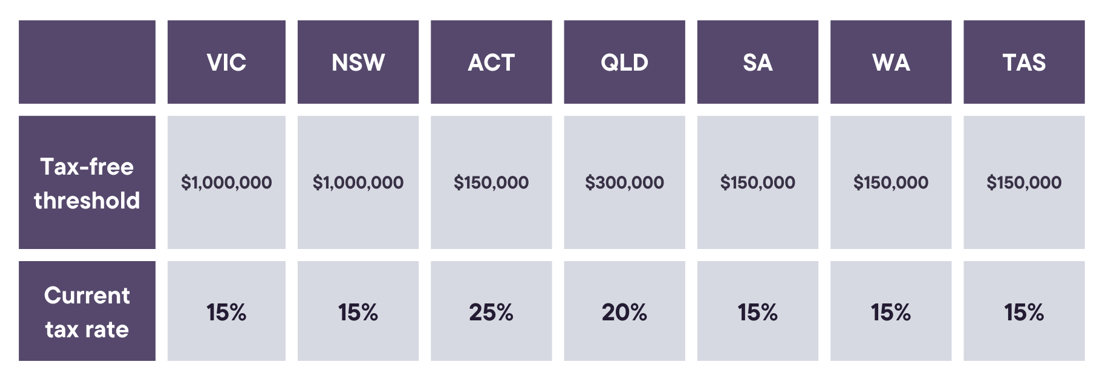

POCT is calculated based on the net wagering revenue from customers from the relevant state or territory. WSP become liable to pay POCT when the net wagering revenue is in excess of the relevant tax-free threshold for the financial year. Table one sets out the POCT rate in each jurisdiction as well as the current tax-free threshold.

Table One – POCT threshold and rate

If hitting the POCT threshold, WSP are required to register to pay POCT; lodge a monthly return and remit the POCT payment to the relevant body. Once the threshold has been met, returns are generally required to be filed even if no tax is payable for the month. An annual return and reconciliation is also generally required.

POCT is payable in addition to other taxes and levies that may apply, such as GST or licensing fees or levies.

How is POCT calculated?

POCT is levied on net wagering revenue which is generally the net amount of revenue (including GST) earned from customers in the particular jurisdiction (being the total amount of all bets minus winnings paid). Each jurisdiction provides specific guidance on the calculation methods, this includes the capturing of free bets (excluding Tasmania) and the treatment of bet backs. WSP need to carefully review the relevant requirements and data fields when completing POCT calculations.

In relation to determining the location of the customer, WSP must take all reasonable steps to ensure that bets placed online or over the phone are captured based on the physical location of the customer at the time of making the bet. This is generally completed using reliable data about a customer’s location (e.g. via geo-location) or physical location. However, regulatory authorities have recognised that it may be difficult to identify the physical location of a customer, in these circumstances operators can generally rely on a customer’s residential address unless the operator knows or has reasonable grounds to suspect, that the address is not the location of the person when they make the bet.How is POCT calculated?

Victorian grouping provisions

In Victoria, the Gambling Taxation Act 2023 (Vic) introduced the calculation and payment of POCT as a group for WSP that have a defined connection between them. If a WSP is considered a member of a group, that WSP net wagering revenue is calculated as part of that group rather than individually. This is the same for the tax-free threshold.

This relates to any WSP receiving wagers from customers located in Victoria, regardless of where the WSP is licensed. To date, there are no similar provisions in other Australian jurisdictions in relation to the payment of POCT.

Below is an outline of how a WSP can be considered as part of a group

Potential penalties

The consequences for non-compliance with POCT can be serious. The respective government authorities have the power to undertake compliance and enforcement activities. This includes the ability to impose penalties and interest for POCT defaults. We are aware of authorities’ conducting audits and investigations to ensure compliance and requiring WSP to provide records and documents to test compliance with the POCT obligations.

At the time of writing, in Victoria, for example, failing to apply for registration for POCT when the entity (or group) has become liable to pay POCT without a reasonable excuse constitutes an offence and significant penalties can be applied (up to $98,795 (500 penalty units) based on the current value of a penalty unit). Penalties and interest for non-payment can be applied on top of that amount.

It is also an offence to avoid or attempt to avoid paying POCT tax. This includes criminal liability for officers of companies in failing to exercise due diligence captured in the Taxation Administration Act 1997 (Vic).

Further Questions

Senet specialise in gambling-related tax. If you have any further questions in relation to the operation of POCT or grouping please get in touch.